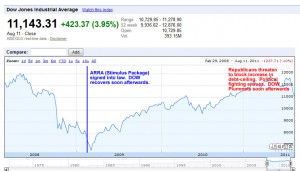

The recent DOW Index plummet and the S&P downgrading of U.S. debt from AAA to AA+ has been followed by much finger pointing. The DOW has clearly been on an upward trajectory since just after the passage of the ARRA (stimulus package). The DOW plummets after weeks of infighting the two parties where Republicans refuse to budge on allowing taxes on the top earners to rise.

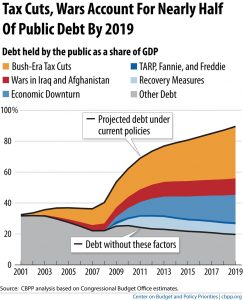

Republicans would like everyone to believe that S&P’s downgrade reflects “reckless spending” and absolve their policies of any wrongdoing. But it’s clear from S&P’s own statement that a disagreement on raising revenues is part of the problem.

We lowered our long-term rating on the U.S. because we believe that the prolonged controversy over raising the statutory debt ceiling and the related fiscal policy debate indicate that further near-term progress containing the growth in public spending, especially on entitlements, or on reaching an agreement on raising revenues is less likely than we previously assumed and will remain a contentious and fitful process. We also believe that the fiscal consolidation plan that Congress and the Administration agreed to this week falls short of the amount that we believe is necessary to stabilize the general government debt burden by the middle of the decade.

Countries With Triple-A Ratings

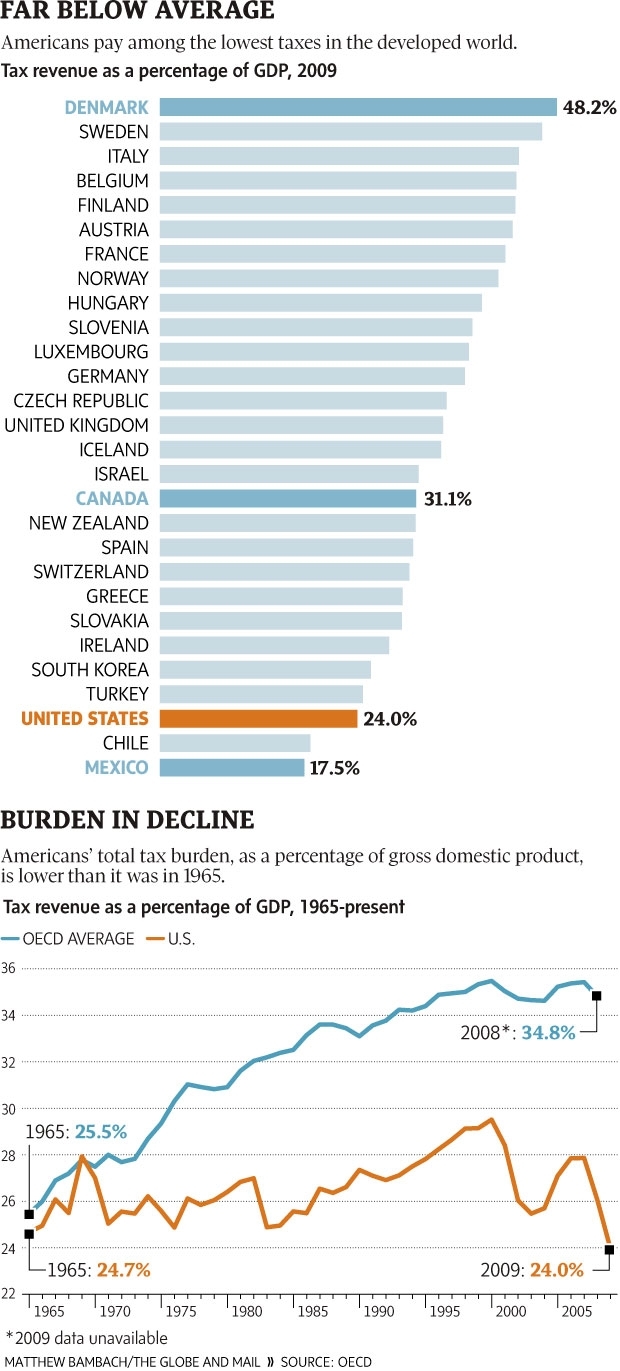

A Fox Business article, The Last Countries With Triple-A Ratings (and Those at Risk of Losing Them) shows the countries which still have AAA ratings. Ironically (for those who believe the S&P downgrade has something to do with the size of US government being too large, almost everyone one of the countries with AAA ratings has a larger government than the US.

Republicans coddling the rich.

Warren Buffett has come out swinging regarding the lack fo will to increase taxes on the top earners.

Stop Coddling the Super-Rich by Warren Buffett

To understand why, you need to examine the sources of government revenue. Last year about 80 percent of these revenues came from personal income taxes and payroll taxes. The mega-rich pay income taxes at a rate of 15 percent on most of their earnings but pay practically nothing in payroll taxes. It’s a different story for the middle class: typically, they fall into the 15 percent and 25 percent income tax brackets, and then are hit with heavy payroll taxes to boot.

Back in the 1980s and 1990s, tax rates for the rich were far higher, and my percentage rate was in the middle of the pack. According to a theory I sometimes hear, I should have thrown a fit and refused to invest because of the elevated tax rates on capital gains and dividends.

I didn’t refuse, nor did others. I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9 percent in 1976-77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off. And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.

Since 1992, the I.R.S. has compiled data from the returns of the 400 Americans reporting the largest income. In 1992, the top 400 had aggregate taxable income of $16.9 billion and paid federal taxes of 29.2 percent on that sum. In 2008, the aggregate income of the highest 400 had soared to $90.9 billion — a staggering $227.4 million on average — but the rate paid had fallen to 21.5 percent.

The taxes I refer to here include only federal income tax, but you can be sure that any payroll tax for the 400 was inconsequential compared to income. In fact, 88 of the 400 in 2008 reported no wages at all, though every one of them reported capital gains. Some of my brethren may shun work but they all like to invest. (I can relate to that.)

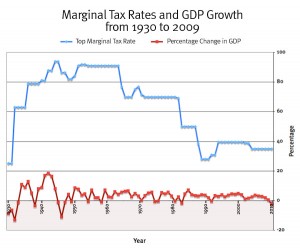

Despite such data delivered in an eloquent fashion from such a credible source as Warren Buffett, Republican politicians will still babble on about taxing the rich being unAmerican or hurting job creation. But there is no real correlation between our historical decrease on top marginal tax rates and GDP growth.

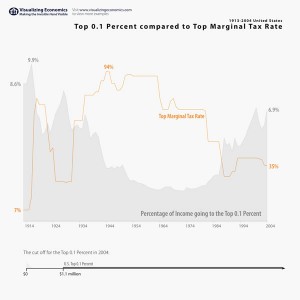

In fact, these lowered tax rates have coincided with more of the wealth coagulating at the top

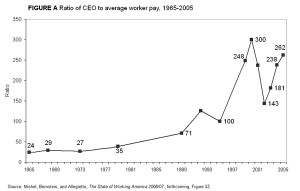

And not surprisingly, we see an increase in wealth disparity.