Claim: Obama has raised the debt more than all previous presidents combined.

Variation: Obama has spent more than all previous presidents combined.

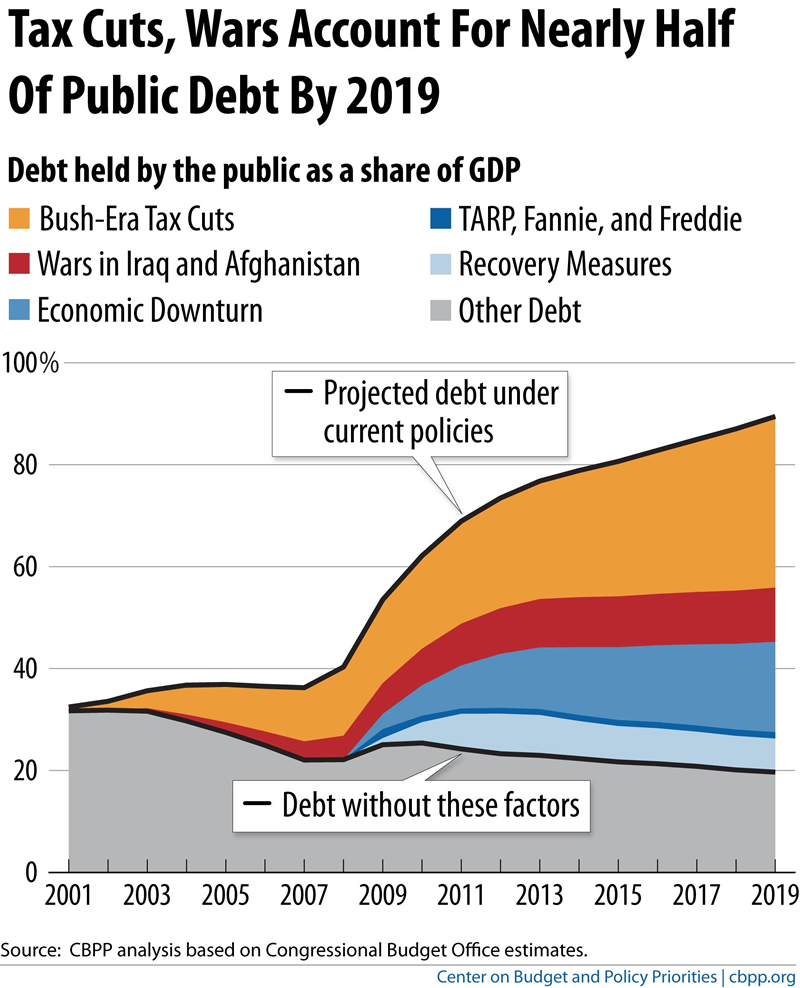

Fact: The second claim is absurdly false since it attributes rising debt to spending as opposed to lowered revenues (the real cause). This first claim is almost “true” if you start the clock at the beginning of President Bush’s last year in office, as opposed to when he left office (or more properly, starting the clock at the beginning of 2010, since the first budget under President Obama would have been set in October of 2009) AND attribute all causes of debt increases to a president’s actions, as opposed to things (s)he can’t control (like inherited recessions, wars and tax cuts). In reality, the fiscal year begins the year prior, and the rising debt has mostly to due with lowered revenues from tax cuts and the 2008 recession, as opposed to increased spending. The claim also avoids any adjustment for inflation or GDP, which any honest comparison would do.

Debt & Spending under President Obama

Did Obama outspend and/or increase the debt more than all previous presidents combined?

The claim that Obama spent more (or at least increased the debt) more than all previous presidents combined requires several false assumptions and omissions.