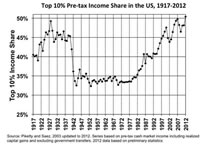

Many have an exaggerated opinion of what markets can achieve. They mistakenly think of markets (and more so, free markets) as some magical force that acts in the best interests of society and makes us all better off in the end. The problem with this assessment is that it is unrealistic and misunderstands how markets work. The market is a compilation of interactions between individuals and organizations who, in general are looking out for their own best interests. Some of the actors have access to more/better information and have far greater leverage than others. Often times the best interest of these actors aren’t aligned with those of the rest of society. And this is when we have a market failure.