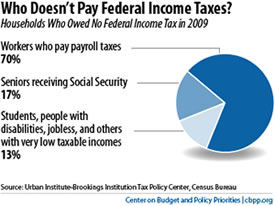

In a private fundraiser a few months ago, Mitt Romney ‘explained’ to his crowd of wealthy donors that Obama firmly had 47% of the vote secured and that this 47%, are the 47% that depend on the government and “pay no income taxes.” Now, it’s categorically untrue that 47% pay no income taxes (it’s true that 47% pay no FEDERAL income taxes, and this doesn’t exclude them from paying state or other local income taxes, nor payroll or sales taxes–and these last two hit the bottom earners at a higher percentage than top earners).

In a private fundraiser a few months ago, Mitt Romney ‘explained’ to his crowd of wealthy donors that Obama firmly had 47% of the vote secured and that this 47%, are the 47% that depend on the government and “pay no income taxes.” Now, it’s categorically untrue that 47% pay no income taxes (it’s true that 47% pay no FEDERAL income taxes, and this doesn’t exclude them from paying state or other local income taxes, nor payroll or sales taxes–and these last two hit the bottom earners at a higher percentage than top earners).

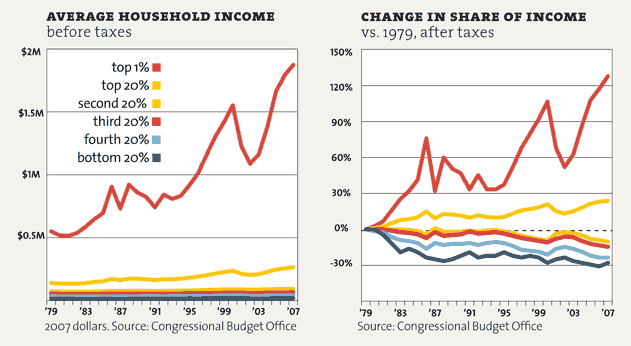

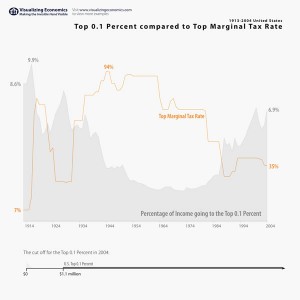

The 47% who aren’t paying federal income taxes aren’t paying into this bucket because their wages have fallen below a certain threshold as more and more of their productivity goes to the top 1%. In terms of after-tax income, the bottom half has gotten most of the shaft. Mitt Romney and his puppet masters would have us demonize these low income earners for not paying federal income taxes.

Republican apathy toward this continuing trend is astounding. Here are the facts.

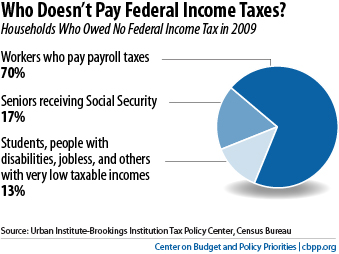

- The 47% who pay no federal income taxes comprise of 70% who pay into payroll and other taxes

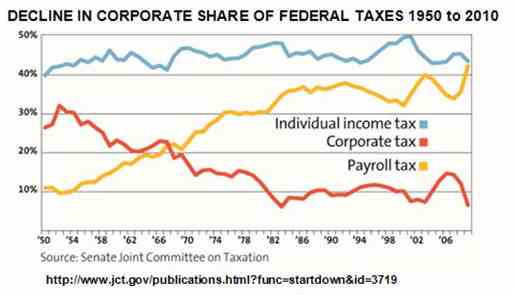

- Payroll taxes eat up a higher percentage of lower incomes, and have taken on a higher percentage of the overall tax burden as income taxes have been lowered

- In terms of after-tax income, it’s the lower earners who have had it the worst over the last 3o years as their wages continue to fall relative to the costs of living

- Included in the 47% are senior citizens collecting SSI, students, and people on disability

- The statement that the 47% who pay no federal income taxes and the roughly 47% who are solidly Democratic voters in this election are the same is insulting as it insinuates a number of stereotypes regarding people’s reasons for voting.

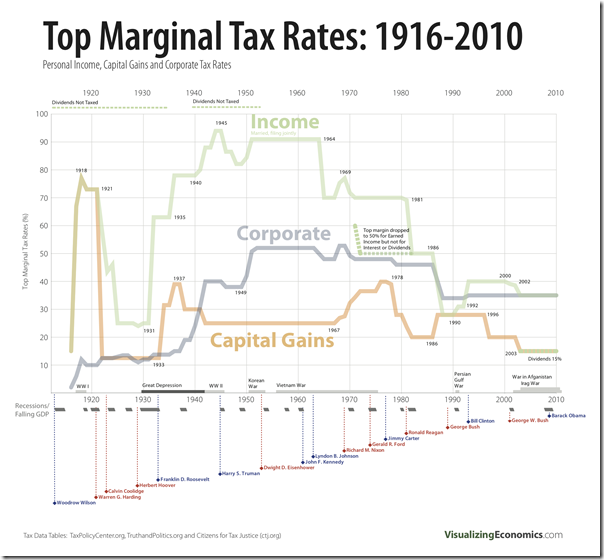

- Mitt Romney’s tax rate is actually lower than many middle income earners

- Mitt Romney himself has benefited from government bailouts